In the absence of a quorum, a majority of the directors present may adjourn a meeting from time to time until a quorum is present. If a quorum is present when a duly called or held meeting is convened, the directors present may continue to transact business until adjournment, even though the withdrawal of a number of directors originally present leaves less than the proportion of number otherwise required for a quorum. Unless the articles or bylaws provide for a different time period, a director may call a board meeting by giving at least ten days’ notice or, in the case of organizational meetings, at least three days’ notice to all directors of the date, time, and place of the meeting. The notice need not state the purpose of the meeting unless this chapter, the articles, or the bylaws require it.

Subd. 4.District or local unit election of directors.

- The articles or bylaws may provide that the cooperative or the patron members, individually or collectively, have the first privilege of purchasing the membership interests of any class of membership interests offered for sale.

- If a would-be contributor does not make a required contribution of property or services, the cooperative shall require the would-be contributor to contribute cash equal to that portion of the value, as stated in the cooperative required records, of the contribution that has not been made.

- (6) any restrictions on transfer, including approval of the board, if applicable, first rights of purchase by the cooperative, and other restrictions on transfer, which may be stated by reference to the back of the certificate or to another document.

- The court shall dismiss the proceedings and direct the receiver, if any, to redeliver to the cooperative its remaining property and assets and to file a final report pursuant to section 576.38, subdivision 3.

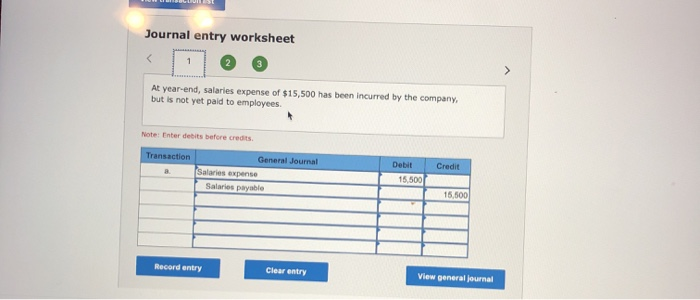

A) nothing is recorded on the financial statements.B) a liability account is created or increased and an expense is recorded.C) an asset account is decreased or eliminated and an expense is recorded.D) a revenue and an expense are recorded. If you run your business using cash accounting, you record expenses the moment you pay for them, and you won’t have accrued expenses in your books. For example, a company wants to accrue a $10,000 utility invoice to have the expense hit in June. The company’s June journal entry will be a debit to Utility Expense and a credit to Accrued Payables. Then, the company theoretically pays the invoice in July at which point they debit the Accrued Payables account to remove the liability (now paid) and credit cash to reflect the cash outflow. Accrued expenses are not meant to be permanent; they are meant to be temporary records that take the place of a true transaction in the short term.

.615 CERTIFICATED MEMBERSHIP INTERESTS.

Then, when the cash is actually paid to the supplier or vendor, the cash account is debited on the balance sheet and the payable account is credited. A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods.

Subd. 9.Indemnification of other persons.

«Minnesota limited liability company» means a limited liability company governed by chapter 322C. «Domestic business entity» means a business entity organized under the laws of this state. «Alternative ballot» means a method of voting on a candidate or issue prescribed by the board of directors in advance of the vote, and may include voting by electronic, telephonic, Internet, or other means that reasonably allow members the opportunity to vote. On Jul. 31, the vendor debits its interest receivable account and credits its interest income account. Then, when paid, Vendor XYZ debits its cash account and credits its interest receivable account. This can include work or services that have been completed but not yet paid for, which leads to an accrued expense.

Subd. 4.Form of certificate.

In other words, with accrual-basis accounting, the recording point is when the money is earned, not when money changes hands. Using the cash-basis method is easier but doesn’t provide the same financial insights that the accrual method does. Using the accrual method, you would record a loss of $2,000 for if an expense has been incurred but will be paid later, then: the reporting period ($2,000 in income minus $4,000 in accounts payable). These short-term or current liabilities can be found on your company’s balance sheet and general ledger. Depending on your accounting system and accountant, they might also be called accrued liabilities or spontaneous liabilities.

Accrued Liabilities: Overview, Types, and Examples

The written action is effective when signed or consented to by authenticated electronic communication by the required members, unless a different effective time is provided in the written action. (b) An amendment to the articles or bylaws that adds, changes, or deletes a greater quorum or voting requirement shall meet the same quorum requirement and be adopted by the same vote and voting groups required to take action under the quorum and voting requirements then in effect or proposed to be adopted, whichever is greater. A waiver of notice by a member entitled to notice is effective whether given before, at, or after the meeting, and whether given in writing, orally, or by attendance. A director’s personal liability to the cooperative or members for monetary damages for breach of fiduciary duty as a director may be eliminated or limited in the articles or bylaws except as provided in subdivision 2. (a) A conference among directors by any means of communication through which the directors may simultaneously hear each other during the conference constitutes a board meeting, if the same notice is given of the conference as would be required by subdivision 3 for a meeting, and if the number of directors participating in the conference would be sufficient to constitute a quorum at a meeting.

Accrued expenses make a set of financial statements more consistent by recording charges in specific periods, though it takes more resources to perform this type of accounting. A company often attempts to book as many actual invoices as it can during an accounting period before closing its accounts payable (AP) ledger. Then, supporting accounting staff analyze what transactions/invoices might not have been recorded by the AP team and book accrued expenses. Accruals impact a company’s bottom line even though cash has not yet changed hands. The accrual method of accounting is the preferred method according to GAAP and involves making adjustments for revenue that have been earned but are not yet recorded and expenses that have been incurred but are not yet recorded.

(b) If the parent is a constituent cooperative and the surviving cooperative in the merger, it may change its cooperative name, without a vote of its members, by the inclusion of a provision to that effect in the resolution of merger setting forth the plan of merger that is approved by the affirmative vote of a majority of the directors of the parent present. (c) After the plan has been adopted, articles of merger or consolidation stating the plan and that the plan was adopted according to this subdivision shall be signed by the chair, vice chair, records officer, or documents officer of each cooperative merging or consolidating. (6) for a consolidation, the plan shall contain the articles of the entity or organizational documents to be filed with the state in which the entity is organized or, if the surviving organization is a Minnesota limited liability company, the articles of organization.

An action may not be commenced under subdivision 1 until 30 days after notice to the cooperative by the attorney general of the reason for the filing of the action. If the reason for filing the action is an act that the cooperative has done, or omitted to do, and the act or omission may be corrected by an amendment of the articles or bylaws or by performance of or abstention from the act, the attorney general shall give the cooperative 30 additional days to make the correction before filing the action. Tangible and intangible property, including money, remaining after the discharge of the debts, obligations, and liabilities of the cooperative shall be distributed to the members and former members as provided in the articles or bylaws, unless otherwise provided by law. If previously authorized by the members, the tangible and intangible property of the cooperative may be liquidated and disposed of at the discretion of the board. (a) A plan of merger or consolidation shall be adopted by a domestic cooperative as provided in this subdivision. If a cooperative accepts more than one contribution pertaining to the same series or class at the same time, then for the purpose of the restatement required by this section, the cooperative may consider all the new contributions a single contribution.

Every accrued expense must have a reversing entry; without the reversing entry, a company risks duplicating transactions by recording both the actual invoice when it gets paid as well as the accrued expense. On the other hand, an accrued expense is an event where a company has acquired an obligation to pay an amount to someone else but has not yet done so. For example, there is a lawsuit that the company is expected to lose, so the company records the expense and a liability for the expected payment, even though it has not been paid yet. Therefore, it is literally the opposite of a prepayment; an accrual is the recognition of something that has already happened in which cash is yet to be settled.