Equity analysts use the DCF model to estimate the fair value of a company’s stock. If the project had cost $14 million, the NPV would have been -$693,272. That would indicate that the project cost would be more than the projected return. If it is, the investment will be profitable and is worth considering. If you perform multiple valuations per year, and valuations are a significant part of the work you do, then using a tool that automates most of the process can make your life much easier.

Discounted Cash Flow Analysis—Your Complete Guide with Examples

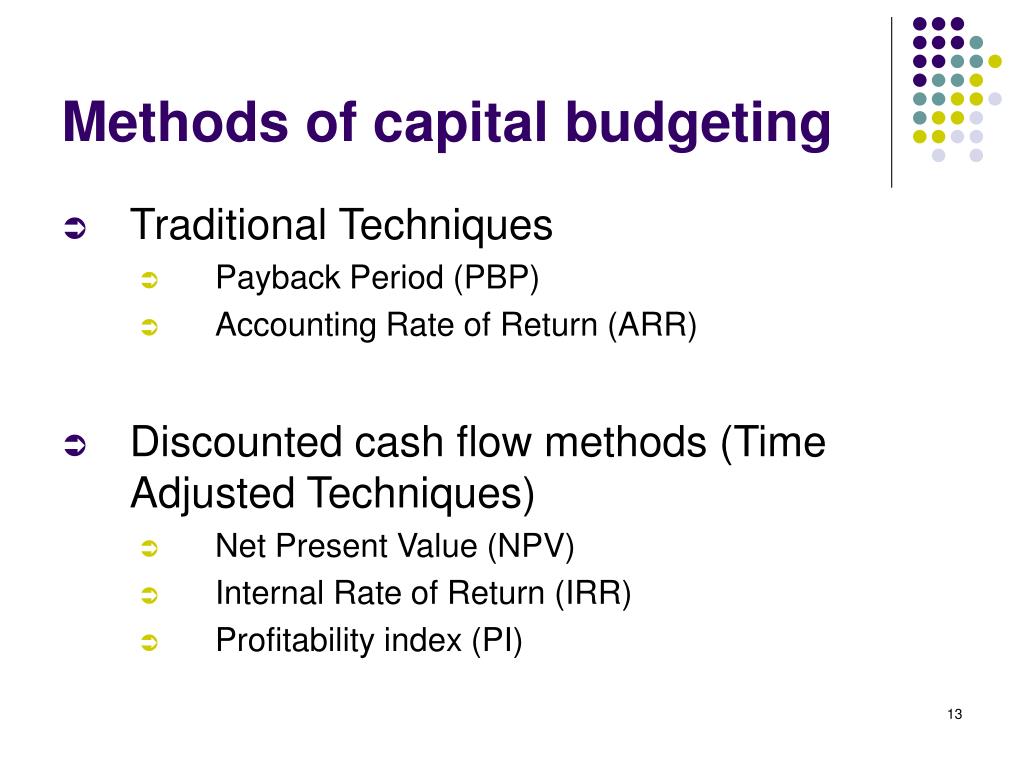

Payback analysis is the simplest form of capital budgeting analysis, but it’s also the least accurate. It is still widely used because it’s quick and can give managers a «back of the envelope» understanding of the real value of a proposed project. Project managers can use the DCF model to decide which of several competing projects is likely to be more profitable and worth pursuing. However, project managers must also consider any risks involved in pursuing one project versus another. The discount rate is a key input in the DCF model and has a big impact on the results. The DCF model can be used to value a wide variety of investments, projects, or companies.

5: Capital Budgeting Decision Techniques

The result can be inordinately positive or negative outcomes that make the analysis useless for decision-making purposes. If there were unequal cash flows each period, the Present Value of \(\$1\) table would be used with a more complex calculation. The profitability index measures the amount of profit returned for each dollar invested in a project. This is particularly useful when projects being evaluated are of a different size, as the profitability index scales the projects to make them comparable. The profitability index is found by taking the present value of the net cash flows and dividing by the initial investment cost. Discounted cash flow is a valuation method that estimates the value of an investment based on its expected future cash flows.

What is your current financial priority?

Companies and investors should consider other, known factors as well when sizing up an investment opportunity. In addition, comparable company analysis and precedent transactions are two other, common valuation methods that might be used. The decision rule for independent projects is to accept all projects with a positive NPV. For mutually contribution margin ratio: formula definition and examples exclusive projects, accept the project with the highest positive NPV. Both the free cash flows, and the Terminal Value need to be discounted. Let’s say the discount rate, using the WACC, is 12% (so, this is a risky business – the higher the WACC, the riskier the business as investors expect to be compensated for taking on additional risk).

By using a DFC calculation, investors can estimate the profit they could make with an investment (adjusted for the time value of money). The value of expected future cash flows is first calculated by using a projected discount rate. This gives us an IRR of 29.02% (in other words, we are expecting to earn an average rate of return of 29.02% per year over the next three years on our $1000 investment that we are making today). However, in order for this IRR to be realized, we will need to take the $800 that is generated at the end of year one and reinvest it somewhere for the remaining two years at 29.02%. Well, how many investments do you know that pay nearly 30% rates of return? As such, our average return is biased upwards (as we will likely earn much less than the 29% needed on reinvested cash flows).

For example, if an investor requires a higher return, they can simply adjust the discount rate accordingly. Scanning the Present Value of an Ordinary Annuity table reveals that, when the present value factor is \(4.564\) and the number of periods is \(7\), the interest rate is \(12\%\). This not only exceeds the \(7\%\) required rate, it also exceeds Option A’s return of \(8\%\) to \(10\%\). Based on this outcome, the company would invest in Option A, the project with a higher profitability potential of \(1.157\). For DCF analysis to be useful, estimates used in the calculation must be as solid as possible.

- However, if you could only take one of these two projects, which would be better?

- The bias is smaller for projects that are back loaded (cash flows coming in primarily later in the project life).

- Using our example above, the precise discounted payback period (DPP) would equal 2 + $2,148.76/$2,253.94 or 2.95 years.

- Discounting cash flows is important because it takes into account the fact that money today is worth more than money in the future.

- This is particularly useful when projects being evaluated are of a different size, as the profitability index scales the projects to make them comparable.

The discounted payback method takes into account the present value of cash flows. Using our example above, the precise discounted payback period (DPP) would equal 2 + $2,148.76/$2,253.94 or 2.95 years. In the example, the investment recovers its outlays in a little under three years. When deciding on any project to embark on, a company or investor wants to know when their investment will pay off, meaning when the cash flows generated from the project will cover the cost of the project.

All individual year present values are added together for a total present value of \(\$44,982\). The initial investment of \(\$50,000\) is subtracted from the \(\$44,982\) to arrive at a negative NPV of \(\$5,018\). The negative NPV value does not mean the investment would be unprofitable; rather, it means the investment does not return the desired \(5\%\) the company is looking for in the investments that it makes. Additionally, a company would determine whether the projects being considered are mutually exclusive or not. If the projects or investment options are mutually exclusive, the company can evaluate and identify more than one alternative as a viable project or investment, but they can only invest in one option.