This is important for accurate financial reporting and compliance with… These figures are transferred from their respective accounts to the manufacturing account in the same way as figures relating to the purchase and sale of goods are transferred to the trading account. Thus, all the costs from both departments are accounted for and allocated to the proper category. Total costs of $9,650 are the $4,950 transferred in from the mixing department plus the $4,700 incurred in baking and packaging. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Review Questions

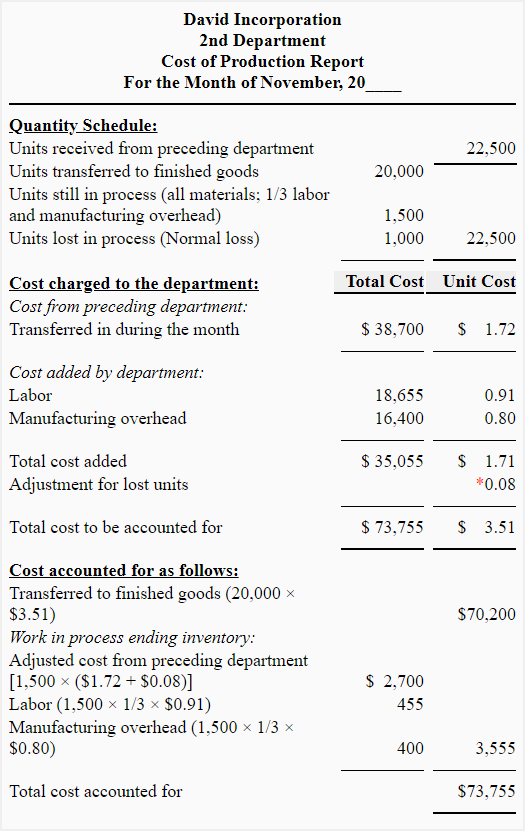

Rounding the cost perequivalent unit to the nearest thousandth will minimize roundingdifferences when reconciling costs to be accounted for in step 2with costs accounted for in step 4. Part 4 of the cost of production report requires you to compute the costs accounted for, also called the cost reconciliation schedule. The cost of goods sold is the sum of all costs for units started and completed during the period. The cost of production report is a financial statement that summarizes the total cost of manufacturing a product or service during a specific period.

Submit to get your question answered.

It can also compare with historical performance to provide some context to the data. An example of how to use Excel to prepare a production cost report follows. Notice that the basic data are at the top of the spreadsheet, and the rest of the report is driven by formulas.

Production Schedule Template

Therefore, there are a few more steps in creating the Production Cost Report. Production reports seek efficiencies and one area that can always be improved is resources. At this point, their availability can be set, such as vacation days, PTO and global holidays. Use the team page or color-coded workload chart to see the team’s allocation and balance their workload to keep them working at capacity.

He has taught accounting at the college level for 17 years and runs the Accountinator website at , which gives practical accounting advice to entrepreneurs. Process Costing always follows the same process while job-order costing applies to each job separately. The MST Manufacturing Company produces one product that passes through a single process in a manufacturing cycle lasting approximately 18 days. EUs for beginning inventory is the complement of last month’s ending inventory because now you are finishing them up. If the beginning work-in-process inventory is 10% done, then the factor to use to calculate EUs to finish it up this month is 90%. Understanding average cost is an effective way to help determine the final selling price with details from the balance sheet.

How Do Managers Use Production Cost Report Information?

To take advantage of this useful manufacturing tool means first understanding what production reporting and a production report are. To make production reports even clearer, we’ll then outline a production report example. Finally, we’ll add links to free project management templates to help manufacturers deliver on time and within budget. The cost of production report can be used by management to make decisions about how to allocate resources and to improve efficiency. For example, management could use the report to identify areas where costs are high and to take steps to reduce costs.

- Factory overhead’ is a term used in business management for expenses related specifically with the cost of maintaining the premises, plant and equipment within a factory.

- A production order will contain information such as how many units will be produced, what materials and labor costs will be needed, and how much will be expected to cover fixed costs.

- Because we calculated EUs based on completed units, including EUs that represent the effort it took to complete the beginning inventory, we divide ONLY costs added during the period by our Equivalent Units.

- Basically, it’s how much it costs you to produce a single product or service, or the cost per unit.

- Balancing all of these demands, like production costs and projected revenue, is a critical element of any business’s success.

- Essentially, this is the total cost incurred for production including any changes to production volume.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

This KPI analyzes and compares similar equipment, production lines and manufacturing plants. It’s calculated by dividing the total number of good units produced by the specific time frame. A manufacturing KPI is a metric to understand the efficiency of the production process. It should reflect strategic where is my stimulus payment goals, be quantifiable and measurable, but also attainable and actionable. The following is a project report example of those fundamental manufacturing KPIs that production managers track. The production cost report for the month of May for the Assemblydepartment appears in Figure 4.9.

Plus, they’re going to help determine the final price point that you offer your product or service to your customers. When you produce an additional unit, you’re going to see an incremental increase in your total cost. This is the marginal product cost and they’re most often related to variable costs. When you produce a product or service, production costs are any expenses incurred along the way.