NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues.

Dividend Yields and Inflation

- These payments, usually paid on a quarterly basis, are a form of reward for shareholders who are the company’s owners.

- Trailing dividend yield gives the dividend percentage paid over a prior period, typically one year.

- NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

The dividend yield ratio is the ratio between the current dividend of the company and the company’s current share price – this represents the risk inherently involved in investing in the company. Investors seeking income from dividend stocks should maintain their concentration on stocks with at least a 3%-4% yield. On the other hand, the dividend payout ratio measures the amount of a company’s earnings that are paid out to shareholders as dividends. A lower payout ratio is generally seen as more sustainable, indicating the company retains enough earnings to reinvest in its operations or prepare for future downturns.

Common shares

In this article, we’ll explain the meaning of dividend yield, which is an important figure to understand when researching dividend-paying stocks. A dividend is the distribution of part of a publicly-traded company’s profits to its shareholders. US companies usually pay dividends on a quarterly basis, but sometimes they are paid on a monthly, semi-annual, or annual basis. Dividends can come in the form of cash payments or shares and are determined by the company’s board of directors. • Investors need to look beyond yield to the type of dividend they might get. An investor might be getting high dividend payouts, but if they’re ordinary dividends vs. qualified dividends they’ll be taxed at a higher rate.

How to calculate dividend payout – dividend example

She has worked in multiple cities covering breaking news, politics, education, and more. Companies in certain sectors of the economy tend to have higher dividends than others. That’s why it can help compare a company with its peers rather than the market. In this article, you will find out what a dividend is and how to calculate dividends. We’ll also walk you through a simple dividend example to demonstrate how to use our tool. Like REITs and Tobacco, other sectors like Telecommunications, Master Limited Partnerships, and Utilities also tend to show relatively higher dividend yield Ratios.

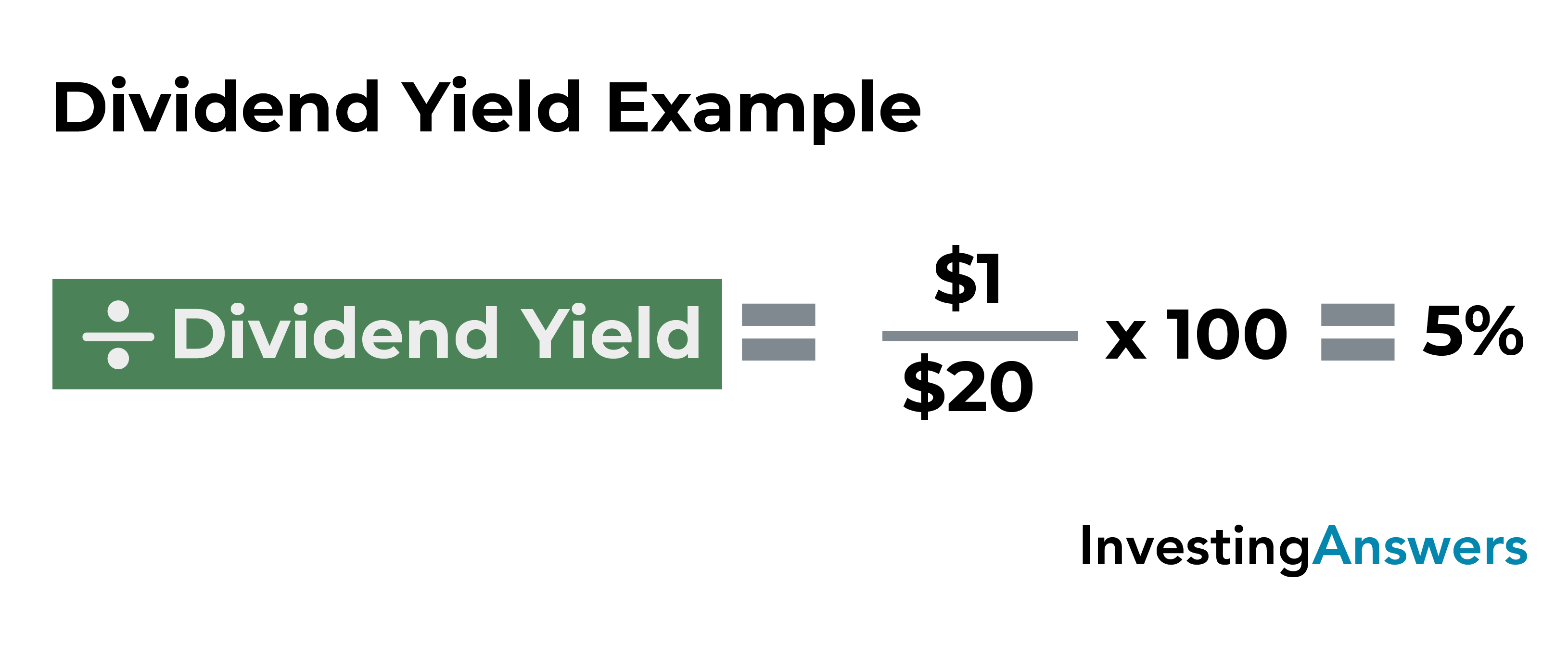

However, if a stock’s yield is increasing too rapidly, that could be a dangerous sign for the company’s overall health. Calculating a stock’s dividend yield is an important part of knowing the overall value of the stock. It shows how much money per dollar invested you can expect to receive back from the company in dividends. Generally speaking, older, more mature companies in settled industries tend to pay regular dividends and offer better dividend yields. Meanwhile, younger, faster-growing companies tend to reinvest their profits for growth instead of paying out a dividend. Suppose Company A’s stock is trading at $20 and pays annual dividends of $1 per share to its shareholders.

The Wharton Online & Wall Street Prep Applied Value Investing Certificate Program

Keep in mind that dividend yield is rarely consistent and may vary further depending on which method you use to calculate it. Real estate investment trusts (REITs) are an example of a high-dividend sector that is difficult to compare from a dividend perspective. U.S. residents who open a new IBKR Pro account will receive a 0.25% rate reduction on margin loans. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. © 2024 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.

Historical evidence suggests that a focus on dividends may amplify returns rather than slow them down. For example, according to analysts at Hartford Funds, 69% of the total returns from the S&P 500 are from dividends. This assumption is based on the fact that investors are likely to reinvest their dividends back into the S&P 500, which then compounds their ability to earn more dividends in the future.

It can also serve as a warning sign if the yield is significantly higher than similar companies. Dividend yield is a useful metric when applied appropriately, and when the time is taken to understand whether the company behind the payout is able to keep paying it. One of the most popular is Realty Income (O 2.0%), which we can use as an example. As of June 2023, the most recent dividend was $0.255 per share, and the share price was near $60. Let’s use the formula in the previous section to determine the dividend yield. It’s important to realize that a stock’s dividend yield can change over time, either in response to market fluctuations or as a result of dividend increases or decreases by the issuing company.

✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here). It’s important to really drive home the difference between dividend yield and dividends in general.

Therefore, the company’s dividend yield is calculated as 0.32 divided by 101 for a dividend yield that rounds up to 0.32%. Regardless, if you’re evaluating stocks for income potential, you’ll want to understand how dividend yields work. A stock’s dividend how to keep your side hustle from messing up your taxes yield shows how much recurring income stockholders have gotten in the last year as a percentage of the current value of shares they own. Investors tend to look at dividend yield as a signal of whether it might be profitable to buy and hold a stock.

Ordinary dividends are taxed as income; qualified dividends are taxed at the lower capital gains rate, which typically ranges from 0% to 20%. If you have tax questions about your investments, be sure to consult with a tax professional. Dividends are a portion of a company’s earnings paid to investors and expressed as a dollar amount.