These facilities should conduct some sort of background check on potential residents in order to ensure the safety of their current residents. Having such a great support system gives residents the opportunity to avoid the isolation that can sometimes occur during the process of returning to their former homes while in recovery. It also provides residents with an environment to help support them during their recovery from substance abuse and also addiction, from those who are just transitioning over from their stay in rehab.

Sobriety and addiction recovery resources in East Boston Area

For some people in recovery, a sober living home can make the difference between staying sober and relapsing back into their addiction. Our «family» way of life will provide a safe and clean environment that is ideal for continuing long-term recovery. We provide a structured environment for recovering addicts to begin living their lives clean and sober outside the confines of a drug treatment center or detention center. Tharros House, located steps away from the center of Lexington, spans 4 levels with almost 8000 square feet of living space. All client guest rooms at Tharros are equipped with queen sized Serta Presidential Euro-top premium mattresses and high thread count linens.

Partnership Referral & Aftercare Supports

We can help with referrals to clinical therapy, couples and family counseling, addiction classes, therapy groups, nutrition and wellness services, life coaching, stress management, exercise and physical training. It’s a red flag if the sober home you are considering does not have trained or certified staff. It is important that the staff working at a sobriety house has a certain amount of training and experience to ensure that they can handle issues that may arise during a resident’s stay. A well-trained staff can also lead more effective group meetings and other events offered by the sober living home to its residents. Look for a sober living home that has a set of rules / minimum requirements. The biggest requirement should be that all residents are alcohol and drug-free in order to promote a positive environment for addiction recovery.

We Also Offer Less Structured Sober Living

Our team will guide you in developing healthy habits, setting goals, and addressing any challenges that may arise during the recovery process. At Teras, we offer structured sober living with flexible structure to meet the needs of those returning to family, work, school, or other commitments. At Teras, our experienced team, plus ancillary providers, provide a high level of support for clients to take action in a recovery fellowship, and engage outside structure. If you are looking for a sober living home in the Boston Area of Massachusetts, the Tharros House is a stand-out facility that can help you maintain your sobriety and grow as a person in the process. The Tharros House combines a sober living community with aftercare in order to assist their clients in acquiring new skills to meet life’s challenges. Sober living homes can act as a supplement to a person’s recovery from addiction.

Useful East Boston Links

- At Tharros, we offer semi-private to fully private ensuite accommodation.

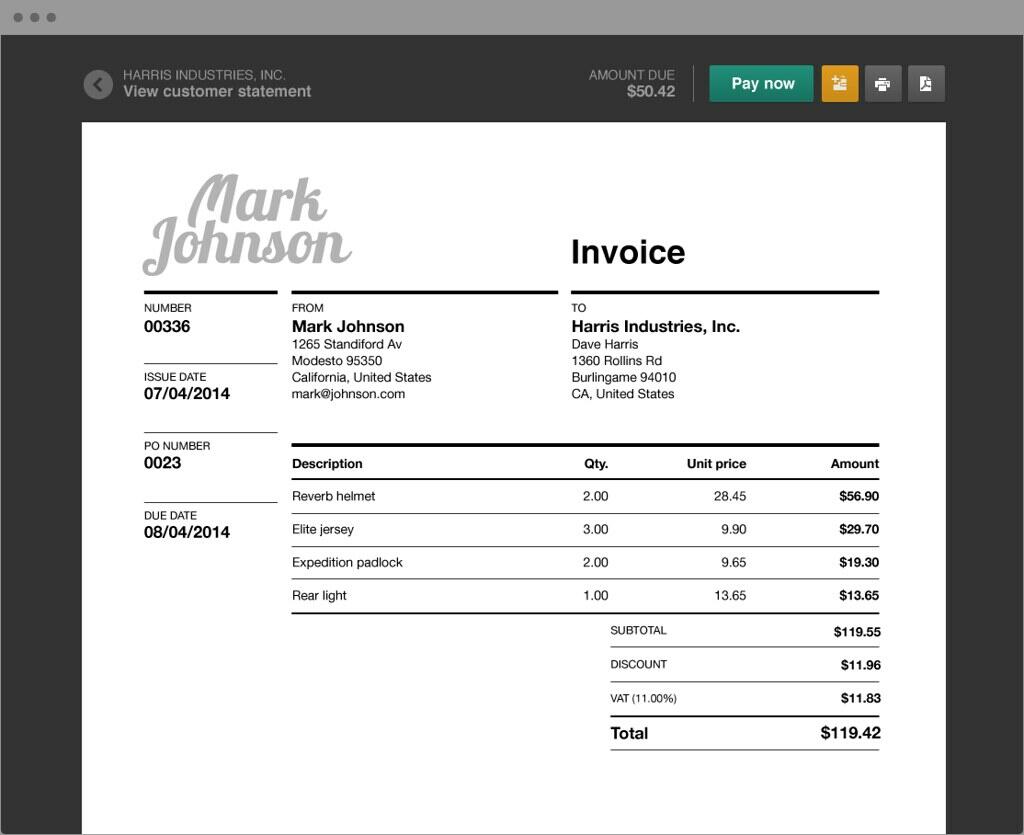

- Monthly fees at Tharros include food for all meals and snacks, transportation by our team in commercially insured SUVs, all activities, Tharros groups, and peer mentoring support.

- Moving into a sober home has the benefit of helping you create a solid support system with friends who are going through the same or similar things that you are.

- Applications are accepted on our website, as well as faxed, e-mailed, or over the phone.

- A day center at Eliot Presbyterian Church serves about 150 people a day — triple the number it was helping a year and a half ago, according to operations director Charlie Ott.

The VSL and Vanderburgh House ™ brands are used with permission by VSL Chartered Operators. Sober homes screen guests for alcohol and drugs, enforce house rules and curfew, and each guest holds their brothers and sisters accountable. Sober homes offer an opportunity for men and women in recovery to live together and support each other while pursuing a new life in recovery. We strive to create a mutual respect and accountability culture where residents can feel comfortable and secure in their journey toward lasting recovery. Through community involvement, holistic wellness practices, and evidence-based therapies, we aim to help our residents build the foundation for a fulfilling and sustainable life in recovery. You are more likely to maintain long-term sobriety by entering and committing to a structured transitional living environment, like Tharros House.

- Although sober living houses tend to be less restrictive than inpatient facilities are, these homes still do have rules that residents are required to abide by.

- Those are small- to mid-sized cities, including Lowell, Revere, Fall River and Fitchburg, that were once thriving industrial centers and now face significant economic issues.

- It also provides residents with an environment to help support them during their recovery from substance abuse and also addiction, from those who are just transitioning over from their stay in rehab.

- It can also give residents the tools to learn and practice healthy coping skills during times of high stress and cravings or urges to use.

- We take privacy seriously, and client information is not shared with any outside sources, except those affiliated with treatment, or which the client otherwise requests.

- Our team makes sure to build a connection which each resident’s clinical providers in order to help fully understand what support is needed before that resident moves in.

- These facilities should conduct some sort of background check on potential residents in order to ensure the safety of their current residents.

- Through therapy, residents may learn to identify triggers that could entice them to go back to engaging in substance abuse once they leave the sobriety house and re-acclimate into the community.

Applicants must be over 18 years old and haven’t used drugs or alcohol within 14 days. Guests are ofter referred from treatment or other sober living boston clinical or judicial settings, but many guests self-refer to our homes. Sober houses offer an important service to individuals in early recovery. Independent living is difficult, and sober housing offers an attractive alternative to many options available to men and women in early recovery. The house’s Boston location is ideally located on the border of Brookline and Newton just off Beacon Street in Cleveland Circle. Additionally, it is around the corner from the Subway B, C, and D green line.

- He said he splits his time between a tent along the river and his sister’s house.

- Sober homes offer an opportunity for men and women in recovery to live together and support each other while pursuing a new life in recovery.

- For others, after 1-6 months at Tharros, clients may choose to transition to Teras.

- When you stay in an inpatient treatment center, as a patient, you are completely immersed in the center’s rehab programs, and you typically do not have a lot of independence.

- Please visit Vanderburgh Communities for more information on how to become a sober living Operator with the Vanderburgh House system.

- We support clients as they ease their way back into life by giving them support in navigating day to day living, while maintaining a foundation of structure that guides them as they begin to build a new life for themselves.

Teras House

Lowell City Manager Tom Golden pointed to a steady influx of unhoused people from other Massachusetts cities as a key factor in so many people living out in the elements in Lowell. Lowell has been overwhelmed by a growing population of people living outside on the streets since the pandemic faded. Tensions around the issue have dominated public conversations as the city has grappled with how to respond. Arlo House has established relationships with a multitude of clinical service providers that include in-person Intensive Outpatient & Partial Hospitalization Programs, and clinicians who specialize in Substance Use. Tharros House amenities include a full chef’s style kitchen with high-end appliances, a ping pong table, flat-screen TVs, and a quiet dining room.

Tharros House is a private peer program which is not affiliated with any state or federal offerings. Testimonials are available on our site, and we are happy to connect you with families and past clients who can share their experience with you. We take privacy seriously, and client information is not shared with any outside sources, except those affiliated with treatment, or which the client otherwise requests. Monthly fees at Tharros include food for all meals and snacks, transportation by our team in commercially insured SUVs, all activities, Tharros groups, and peer mentoring support.