Take the stress out of sales tax in the United States with insights and collection built into your admin. It helps you estimate whether a given project or investment would result in more money coming in, or if you’d lose money on the venture. Understanding how to calculate Net Present Value is beneficial for your long-term financial planning. You may need to re-strategize and make adjustments to ensure you stay on top of your business.

- A ProAdvisor can assist you with small-business bookkeeping and installing or learning how to use cloud accounting software.

- Don’t forget to visit the QuickBooks bookkeeping hub where you can find additional helpful information and definitions.

- However, it can be difficult to catch up if you fall behind on reconciling transactions or tracking unpaid invoices.

- As a business owner, it is important to understand your company’s financial health.

Accounting ledger

If you’re paying employee taxes or sales tax, you’ll need to prepare a quarterly report for remitting payments to the IRS and other required taxing agencies. Income is recorded as it’s received; otherwise, it’s not considered revenue. A disadvantage of the cash method is that it only provides a short-term look at your company’s financial health. With the right tools, you can feel confident managing financial transactions and helping your business grow. Continue reading to discover why small business accounting is important, as well as how to streamline your business’s finances.

What Are the Best Practices for Maintaining Accurate Financial Records?

Record and categorize your documents every week during your weekly bookkeeping session. Quick, regular audits of your documentation and transactions will ensure that you’ll never have extraordinary items under gaap a stressful night’s sleep—at least as far as your books are concerned. Get in the know with our how-to guide to bookkeeping basics for small business owners. DIY bookkeeping is simplest when you break it into manageable chunks—don’t try to do it all at once.

Record transactions

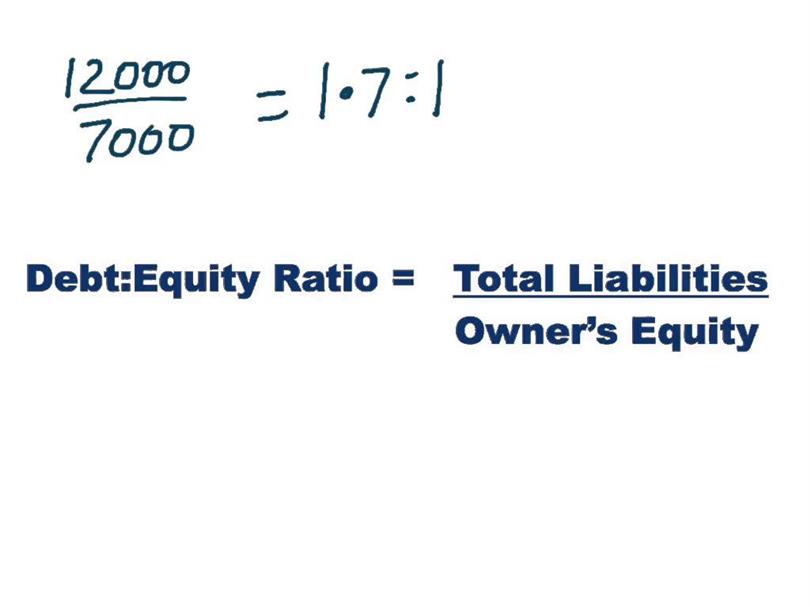

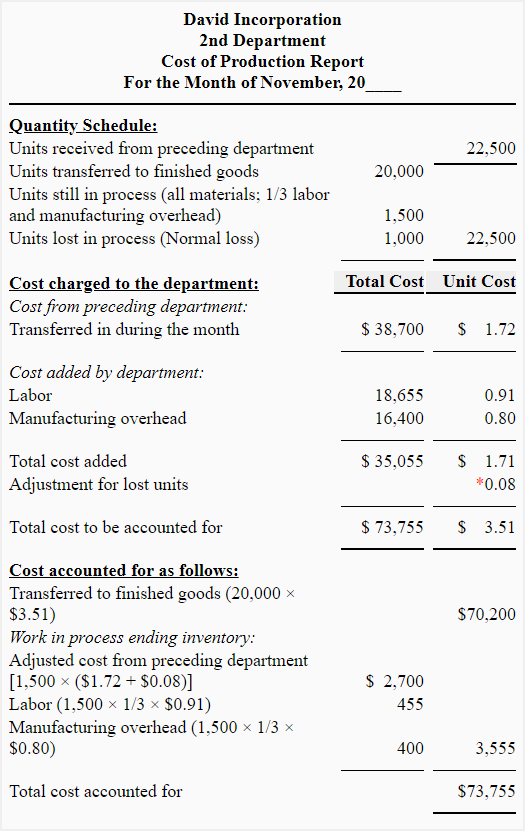

Common categories include asset, liability, equity, revenue, and expense accounts. If you select one accounting method and then decide that you’d like to change it after filing your taxes, you’d need to complete IRS Form 3115 to formally do so. Minimum deposit requirements can depend on the type of business account and whether you’re opening the account at a traditional bank, credit union, or online bank. Balancing your books allows you to catch any errors or mistakes in your bookkeeping. Tracking your expenses is an essential part of managing your finances.

Will your business be generating how a general ledger works with double-entry accounting along with examples invoices, cost estimates, or billing statements? If you find it feasible to keep your books in-house, you might consider using a software accounting program. This can help alleviate some problems you might run into with manual record keeping.

Use an online bookkeeping service

Those without a budget may not see a problem until a cash crunch arises. Hire the business accounting expertise you need Connect with Shopify experts for free today, so you can grow your business tomorrow. Note that you may need to make quarterly estimated tax payments if you expect to owe $1,000 or more when filing your annual tax return. If you’re managing inventory, set aside time to reorder products that sell quickly and identify others that are moving slowly and may have to be marked down or written off. The Net Present Value (NPV) of your business is a calculation that helps you analyze potential projects or investments that might be worth your while.

For example, if you need to save a copy of a document separately from other files, you may put it in its password-protected folder inside your document management software. The IRS encourages small business owners to maintain proper documentation for expenses, such as receipts showing the amount spent, the date, the payment method, and what was purchased. Accountants provide a higher level of financial analysis and planning. They may use the financial data bookkeepers generate to advise business owners on tax planning and budgeting.

Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Also, if you pay independent contractors $600 or more during the year, you’ll need to send each one a 1099-NEC form, as well as copies to the IRS.

Because the funds are accounted for in the bookkeeping, you use the data to determine growth. If not done at the time of the transaction, what is a bom the bookkeeper will create and send invoices for funds that need to be collected by the company. The bookkeeper enters relevant data such as date, price, quantity and sales tax (if applicable). When this is done in the accounting software, the invoice is created, and a journal entry is made, debiting the cash or accounts receivable account while crediting the sales account.