A beginner’s guide to the expense report, a form businesses use to track and reimburse employee expenses. By translating your financial data into business information, they will be able to provide expert advice on how to improve your performance and grow your business for the next fiscal year. Your accountant can help you create the financial projections necessary for your business plan, but they can also use real data to help you track your progress and plan for the future. An accountant can use the insights gained from monitoring your financial records to help you set goals and determine your key performance indicators (KPIs). While there are some basic financial tasks you can handle yourself, there are others that it’s best to leave to a professional.

Familiarize https://videoforums.ru/showthread.php?t=759 yourself with the features of the different CPA review courses and select the one that best matches your needs. ⇨ Help center and email support – some courses even offer live chat or a personal counselor. Consider this as one of the best investments that you will ever make. However, don’t assume that the most expensive course is the one that will provide you with the greatest benefits. Once you click “continue,” you will be brought to a third-party website. Please be aware, the privacy policy may differ on the third-party website.

A future CPA in Minnesota who passes all four sections on the first try can expect to spend about $1,500. It’s recommended that you sign up for as many sections as you feel comfortable taking in a six-month period. Whether or not it makes sense to hire a CPA for your business depends primarily on the complexity of your financial situation. There are many different scenarios in which you may require assurance services. For example, you may need audited financial statements to http://www.forsmi.com/nedvizhimost/v-tretem-kvartale-peterburgskiy-ryinok-skladskoy-nedvizhimosti-vyiros-na-27-tyis.kv.m.html qualify for funding from an investor.

Best LLC Services

Ask each CPA how they bill for services and try to get a quote for your expected needs. Remember, the hourly cost of hiring a CPA depends significantly on the type of work you need them to do. As you might expect, the more complex and involved the work, the higher the hourly http://sokratlib.ru/books/item/f00/s00/z0000024/st001.shtml rate is likely to be. While cost is an important consideration, it’s equally important to prioritize value and quality when engaging a team to support your small business.

Don’t buy from questionable sellers

If you have a hardship or medical situation that prevents you from sitting, please contact NASBA immediately and request an extension. Extensions are determined on a case-by-case basis and require documentation. There are no additional fees for testing at any other test center outside your jurisdiction within the U.S. and its territories. For information about additional fees for testing in an international location, please refer to the International Administration section of this website.

What kind of information is provided on the Candidate Performance Report?

It is important for international candidates to research the specific eligibility requirements in their chosen jurisdiction, as these may vary between U.S. jurisdictions. Some states may require candidates to complete additional education, while others may have specific rules for determining credit equivalency. Considering these various factors, it’s crucial to research and compare CPA fees to ensure you receive the services best suited to your needs and budget. While the cost of a CPA is a significant consideration, the expertise and guidance they offer can be invaluable in managing your personal or business finances effectively.

- Freelancers generally have simple financial requirements compared to businesses, usually spanning yearly income tax preparation and minimal bookkeeping services.

- Additionally, candidates who test on the same day may receive scores at different times due to differences in necessary quality control procedures.

- This helps clients minimize future tax liabilities while remaining compliant with the latest tax regulations.

- After a candidate has been deemed eligible, then they would submit an exam section application to obtain an NTS.

- Submitting all your information and obtaining your license will come with another fee, which does vary from state to state.

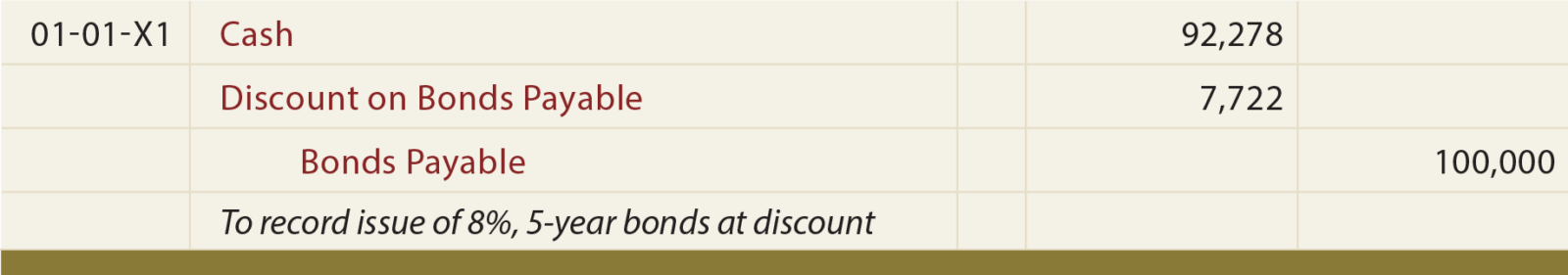

For example, 58% of CPAs don’t charge a fee to file a tax return extension. On average, the CPA fees for preparing a small business tax return can range from $500 to $2,500 or more. This range is influenced by various factors and only includes the cost of the actual tax preparation, without the back-office support like bookkeeping and payroll. Although doing your taxes independently using tax software can save you money versus hiring a professional, working with a CPA has many benefits. Accountants prepare tax returns with much more sophisticated software compared to the software sold to consumers.

PRODUCTS & SERVICES

Certified Public Accountants (CPAs) provide a wide range of services, and one key area is tax preparation. Tax preparation involves gathering and organizing financial documents, determining deductions and credits, and filing tax returns on behalf of individuals and businesses. The cost of tax preparation services varies depending on the complexity of the client’s tax situation. For example, a small business tax return may cost between $500 to $2,500, depending on factors such as the number of transactions, entity type, and industry.

How can I save money on the CPA Exam?

If you’re about to make a change that might significantly impact your tax and financial situation, it’s best to talk to a CPA first. They can explain the potential repercussions and walk you through the process. However, if you have 3 business entities and four rental properties in separate states, you’ll likely need to hire a tax preparer. The Thomson Reuters Institute shared that 95% of accountants have clients asking for broader business advisory services. As a result, CPAs are increasingly taking on a more general consulting role.

CPA costs by business size and industry

You’ll also need to track tasks like calculating capital gains, asset deductions, and fringe benefits tax. However, accountants may charge $2,500 or more to audit financial statements.1 The higher your gross income is, the higher the CPA fixed fee will be. The total cost includes application and administration fees, in addition to the examination fees.

Pick a business structure that suits your needs

NASBA looked at background checks from past years and found that costs to the candidate that ranged from $1 – $49. This is something you’ll want to confirm directly with your state board. In this case, NASBA will send you a payment coupon after your state board has specified which sections you are eligible to sit for. NASBA has set a fee schedule of about $344.80 for each section of the CPA Exam.

Forensic accounting

The fees to take each section of the exam also vary by state, but are roughly $200 per section, or $800 for all 4 sections. In addition to these expenses, you will have to bear two additional costs after you pass the CPA Exam. These aren’t CPA exam costs, but you should know about them all the same.