Contents:

VPNArea is fairly cheap in comparison to other VPNs of a similar quality. VPNArea’s monthly plan is the most expensive option at $9.90, but you can drop this right down to $3.21 on the two-year plan, saving you 67%. A good rating here isn’t just based on how cheap the VPN is, but for the value it offers overall. There are setup guides for all platforms and devices they provide a service for. On the website, there are loads of in-depth FAQs covering a variety of topics from encryption to the security of different VPN protocols. Not every VPN offers all of these, and they often vary in quality and response time.

Apparently, Android users are satisfied with what the client has to offer. Finally, our connection seems seamless in the images below, but it wasn’t like that the whole time. Some servers did not connect at all after waiting for quite some time. They’re so much easier to navigate and the options are just right there. VPNArea also has a neat application on Android, it had great features, yet it missed some. In fact, the latest VPN usage statistics prove that 35% are desktop users while 42% are mobile users, which shows how popular mobile clients are.

The channel’s geo-blocking method differs from that of Netflix as it’s only available in one region only – The United States. First, we recorded our own connection speed without connecting to any VPNArea server. We’ve come across dozens of speedy VPNs before, and we also had our fair share of slow https://coinbreakingnews.info/ ones. A slow VPN is never recommended as it will ruin a user’s browsing experience, especially streaming. In the past, a certain VPN provider started inserting positive reviews to increase its rating. Apparently, Trustpilot figured it out and penalized it by demoting its status even further.

PureVPN, on the other hand, actually improved download speeds by 403.8 percent. In the upload test, it took second place by reducing upload speeds by 2.8 percent. That’s not a big impact at all, but Hotspot Shield Elite eked out a victory by improving upload speeds by 1.4 percent. Like any security product, using a VPN requires a certain degree of trust between you and the VPN company. After all, a VPN company potentially has great visibility into your online activity while you’re connected.

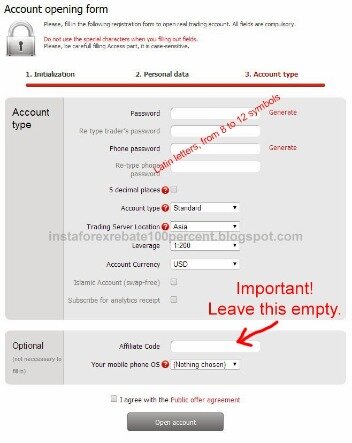

- You sign up for an account, select the type of membership that you want, and enter your payment details.

- On the other hand, it’s hampered by a subpar user experience that extends from the company’s website to its VPN client, and there are only a scant number of servers available.

- Yes, VPNArea protects your data with industry-standard VPN security features like 256-bit AES encryption, a kill switch , and a strict no-logs policy.

- By tunneling your location to a new country/server, Area VPN hides your original IP address, which allows sites and other people to determine your location.

That includes recommended , favorites, P2P, stealth, Special , and dedicated IP. VPNArea is based in Bulgaria, a European country outside the Five, Nine, and 14 Eyes prying jurisdictions. Countries taking part in these intelligence alliances monitor, collect and share user data with each other, and their main focus is Internet surveillance. Moreover, Bulgaria is an EU member, which means it implements the GDPR privacy and security law. Users can also submit a ticket to get an email response from the VPNArea customer service team.

Great, fast support.

People in restrictive countries like China, Iran, and Saudi Arabia can use Stunnel servers to access a free and open internet. VPNs that support WireGuard, like Private Internet Accessand ProtonVPN, always maintained faster speeds in my tests than VPNs that don’t have WireGuard. It’s one of the best VPNs for China, with effective obfuscation and no IP leaks. VPNArea is very fast on local connections and can handle torrenting on all servers.

It allows you to protect your computer, phone, tablet, or even share your account with friends and family. In case you don’t have time to go through our comprehensive and detailed review, here’s a quick summary of what VPNArea has in store. Your comment will be checked for spam and approved as soon as possible.

Speed ratings are calculated using upload speeds, download speeds, and ping . Callum Tennent oversees how we test and review VPN services. He’s a member of the IAPP, and his VPN advice has featured in Forbes and the Internet Society. In the international test, VPNArea again started strong, increasing latency by 252.9 percent. That’s in the best three results for this test, led by AnchorFree Hotspot Shield Elite, which increased latency by 155.4 percent. Again, the download test proved to be a stumbling block for VPNArea, which reduced download speeds by 14.2 percent.

To overcome this obstacle, users recommend to simply connect to a server with fewer users. In the Server & Speed secton, you will be able to choose which server you want to use. You can browse through more than 200 servers in 70 countries. The software uses 256-bit encryption, which makes it practically impossible to decrypt. Simply click on the Settings button at the bottom of the client to reach the options. There again, you can use the tabs to navigate this section more easily.

Kill Switch and Anti-DNS Leak

Aside from that, there are also mobile applications dedicated to Android and iOS mobile devices. On top of that, the VPNArea system can be used and be installed in routers and Smart TVs. VPNArea is a likeable service with decent desktop apps, interesting features and the ability vpnarea reviews to unblock every platform we tried. The mobile apps are a little underpowered and the connection issues are a concern, but may not affect everyone, and shouldn’t stop you giving the VPN a try. Ultimately, I was not very happy with the services offered by VPN area.

For instance, Surfshark, which started operating in 2018, has over 3,200 VPN servers in over 99 countries . VPNArea has servers in over 100 locations and 52 countries. However, the VPN needs your email address to create an account. Since the VPN doesn’t verify the email supplied, you can use a dummy or fake email address.

We saw an impressive average speed loss of just 2% connecting to local VPN servers. However, its international speed performance is poor — often too slow for streaming or torrenting. The more server locations there are, the more likely it is you’ll find a server near your physical location, which generally means better speeds. The more total servers a VPN provides, the more likely you are to find a server that’s not overstuffed with other users, which means you get a bigger slice of the bandwidth pie. But a light bank account should be no obstacle to obtaining a VPN’s protection, and there are many free VPNs available. TunnelBear, for example, limits users to just 1GB a month, but is otherwise an excellent free choice.

Unblocked: Netflix (US, Italy, and the UK) Amazon Prime Video, BBCiPlayer, SkyGo Italy

With closer servers, it was literally like we weren’t even running a VPN. We didn’t experience any speed drops or sudden disconnects, meaning the company really provides what it promises. On the US servers, however, we regularly experienced higher upload than download speeds, which is something that doesn’t happen all that often. All in all, excellent performance without disconnects and little to no speed drops. In the Settings section, you can find several different options. You can choose to run VPNArea every time Windows starts, connect automatically to the last server used, or check for updates.

Users can purchase a dedicated IP, where they’ll be the only ones in the world that have access to it. However, it doesn’t protect their data or anonymize their internet browsing. We searched the whole VPNArea website and couldn’t find anything of the sort.

BBC and Netflix

However, this was quickly solved by just restarting the application. On the topic of streaming, VPNArea even has a dedicated app if you want a VPN for Firestick. This makes VPNArea one of the best cheap VPNs on the market. It’s comparable to what we saw in NordVPN review with the long-term plan, but also cheaper with the monthly and annual rates. VPNArea has native apps for Android, iOS, Windows, macOS, and Linux.

For one thing, no one on the network you’re using—not even the person who controls it—can intercept or read your web traffic. If you frequently use the airport or coffee shop Wi-Fi, this is a critical level of protection. Kodi — VPNArea provides a 13-step guide on how to set it up on Kodi. The process looks detailed and complicated but the instructions are clear for interested users.